成班友仔..各懷鬼胎....講到尾,未又係睇住的放係到無息收的黃金....

Germany has rejected proposals by France, Britain and the US to have German gold reserves used as collateral for the Eurozone bailout fund. Germany Economy Minister Philipp Roesler said on Monday that the German people's gold reserves cannot be touched and “must remain off limits." "German gold reserves must remain untouchable," said Roesler, who is head of the Free Democrats (FDP), a partner in Chancellor Angela Merkel's coalition. Roesler added his voice to opposition to an idea proposed at the G20 summit of using reserves including gold as collateral for the euro zone bailout funds. The Bundesbank and Mr. Seibert, spokesman for Merkel, said Sunday that they too ruled out the idea discussed at the summit of Group of 20 leading economies last week. Mr. Seibert dismissed media reports yesterday that the plan to boost bailout funds, to aid Italy or another large euro zone country, would require Germany to sell off part of its gold and foreign exchange reserves. “Germany’s gold and foreign exchange reserves, administered by the Bundesbank, were not at any point up for discussion at the G20 summit in Cannes,” he said.

From

Goldcore:

Gold is trading at USD 1,767.90, EUR 1,283.90, GBP 1,101.60, JPY 138,011, CHF 1,583.90, and AUD 1,711.70 per ounce.

Gold’s London AM fix this morning was USD 1,764.00, GBP 1,102.78, and EUR 1,286.65 per ounce.

Friday's AM fix was USD 1,756.00, GBP 1,096.47, and EUR 1,269.61 per ounce.

Cross Currency Table

Cross Currency Table

Gold prices have risen in all major currencies due to safe haven demand for bullion on concerns that the debt crisis in Greece, Italy and much of the Eurozone may lead to contagion in markets.

Italian 10 yr government bond yields have surged to 6.61% and saw an inter day high of 6.676% which has contributed to sell offs in European stock indices which followed their Asian counterparts lower.

The ‘safe haven’ Swiss franc has fallen sharply against all currencies including the euro and especially against gold. Gold in Swiss francs has surged 2.4% - from CHF 1,556 to 1,590.

IMF Global Gold Reserves (Million Ounces)

IMF Global Gold Reserves (Million Ounces)

Germany has rejected proposals by France, Britain and the US to have German gold reserves used as collateral for the Eurozone bailout fund.

Germany Economy Minister Philipp Roesler said on Monday that the German people's gold reserves cannot be touched and “must remain off limits."

"German gold reserves must remain untouchable," said Roesler, who is head of the Free Democrats (FDP), a partner in Chancellor Angela Merkel's coalition.

Roesler added his voice to opposition to an idea proposed at the G20 summit of using reserves including gold as collateral for the euro zone bailout funds.

The Bundesbank and Mr. Seibert, spokesman for Merkel, said Sunday that they too ruled out the idea discussed at the summit of Group of 20 leading economies last week.

Mr. Seibert dismissed media reports yesterday that the plan to boost bailout funds, to aid Italy or another large euro zone country, would require Germany to sell off part of its gold and foreign exchange reserves.

“Germany’s gold and foreign exchange reserves, administered by the Bundesbank, were not at any point up for discussion at the G20 summit in Cannes,” he said.

Mr. Seibert was responding to proposals to sell about €15 billion of Germany’s gold reserves of over 3,000 metric tonnes, worth a reported €139 billion.

A Bundesbank spokesperson said it was aware of the plan and said the institution “rejected” plans to touch federal reserves.

The Sunday

Frankfurter Allgemeine newspaper said the initiative marked a fresh round in an ongoing struggle between the Bundesbank and the Merkel administration over reserves the bank manages on behalf of the German people.

The Irish Times reports that today’s finance ministers’ discussion is part of a wider strategy by the

ECB to sound out the possibility of gaining control over the gold reserves of the euro zone’s central banks.

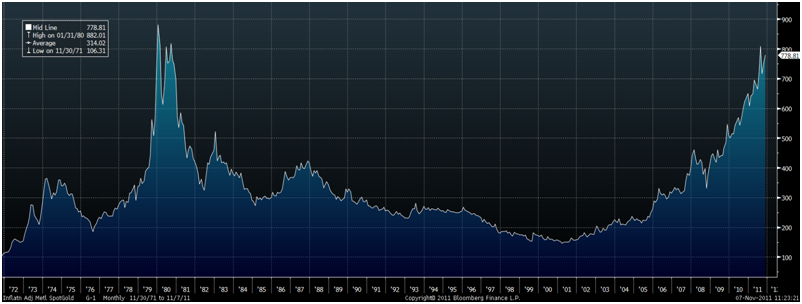

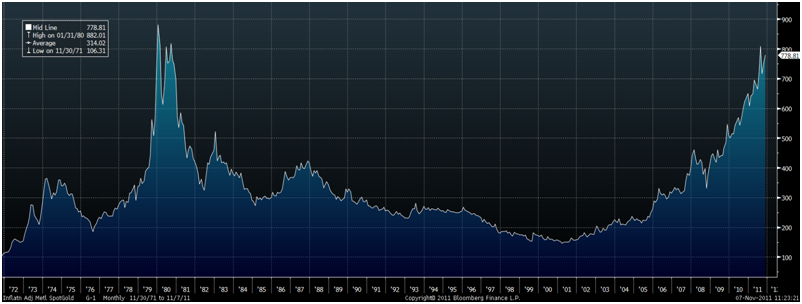

Bloomberg Composite Gold Inflation Adjusted Spot Price – 1971 -2011 (Monthly)

Italian Gold Sale Again Proposed in Germany

Bloomberg Composite Gold Inflation Adjusted Spot Price – 1971 -2011 (Monthly)

Italian Gold Sale Again Proposed in Germany

Senior German politician, Gunther Krichbaum, a lawmaker in German Chancellor Angela Merkel’s governing coalition and Chairman of the Committee on the Affairs of the European Union of the German Bundestag has proposed that Italy sell its sizeable gold reserves in order to lower its debt.

Krichbaum, who chairs the German parliament’s European Affairs Committee, was quoted as saying in the Rheinische Post that Italy’s gold reserves are relatively high and could be used to pay off their sizeable debt.

Using periphery nations’ gold reserves as collateral has been on the agenda in Germany for some months with many influential German politicians calling for debtor Eurozone nations to sell their gold reserves.

Angela Merkel’s budget speaker and his opposition counterpart urged Portugal to consider selling their gold in May of this year.

Senior Minister and rival to Merkel, Ursula von der Leyen, demanded that the debtor ‘PIIGS’ countries offer Germany more reliable guarantees and allow it access to their gold reserves and industrial facilities as payment for loans.

Gold’s value as money and as a strategically important monetary asset is being slowly realized again.