片中有一少少部份,提及共濟會

http://mytv.tvb.com/variety/bigboysclub/126062#page-1

2012年1月5日星期四

Gold above $1600 as Central Banks continue to buy more Gold

http://gold-silver-market.blogspot.com/

After a disappointing QE4 last year , Gold is starting 2012 with a strong upward trend as capital continue to look for safe heavens , the geopolitical uncertainties creating in the straight of Hormuz are going to help gold trade higher , not to mention to continued Eurozone debt problems and uncertainties about the future of the Euro , the fundamentals for gold are stronger than ever Gold is the ultimate safe heaven for the wise capital , and I think we are headed for a very nice rally in this 2012 year ...tighten up your belts we are about to take off .....

After a disappointing QE4 last year , Gold is starting 2012 with a strong upward trend as capital continue to look for safe heavens , the geopolitical uncertainties creating in the straight of Hormuz are going to help gold trade higher , not to mention to continued Eurozone debt problems and uncertainties about the future of the Euro , the fundamentals for gold are stronger than ever Gold is the ultimate safe heaven for the wise capital , and I think we are headed for a very nice rally in this 2012 year ...tighten up your belts we are about to take off .....

:與羅傑斯對著幹,Long金!

1月4日,周三。昨天寫RayDalio,有讀者在《信壇》響應拙文,要求老畢「畫公仔畫出腸」,明示有智慧懂趁勢的對沖世界「真天王」到底?重什麼資產。文人多喜留點想象空間給讀者,惟既然壇友認為有此必要,老畢從善如流,卻又何妨?

根據Bridgewater Associates聯席投資總監RobertPrince對《華爾街日報》的披露,基金持有比重較大的資產為高質政府債券、亞洲新興市場貨幣和黃金。至於「高質」政府債券是否包括評級可能遭下調的歐羅區AAA國債、亞洲貨幣哪些獲垂青哪些榜上無名、金價最高睇幾多,諸如此類,卻非老畢所知了。

另一位投資界名人、有「商品大王」之稱的羅傑斯(JimRogers),本周在獅城接受訪問時,有看好歐羅看淡黃金一說,並作出了相應的投資部署。羅傑斯與RayDalio雖非同一類投資者,惟二人對金價展望背道而馳,一個?另一個便錯,你買邊個?

金價升勢無以為繼?

去年7月初,羅傑斯亦曾向媒體披露個人投資倉盤,老畢印象最深刻的是「商品大王」其時沽空了美國長期國債,同時持有歐羅,對黃金則不置可否。這個部署背後的思路不難理解,聯儲局QE2剛結束,美債孳息易升難跌;另一邊廂,標普下調美國主權評級雖遲至8月5日始作實,惟相關警告早已傳遍市場。聯儲局停止購債加上山姆大叔失去三條A,美債豈能不危上加危?這以外,當然還有長達三十年的美債牛市氣數已盡,泡沫爆破避無可避,跟眼下羅傑斯認定持續了十一年的金價升勢無以為繼,如出一轍。

今天回望,「商品大王」高估了次輪量寬曲終對美債的沖擊、低估了美債在動蕩市況中作為資金避風港的威力,惟強如「債王」格羅斯(BillGross),在美債上亦老馬失蹄,犯上同樣錯誤,只為個人管理財富毋須向客戶交代的羅傑斯,自然沒有必要為看錯市耿耿於懷。

歐羅只宜短炒

事隔半年,「商品大王」再次向媒體透露個人投資部署,建議Short金、Long歐羅,金價睇千二至千三美元,但歐羅則講到明走短線,博太多投資者同一時間看淡,短倉過於「擠擁」(crowded),對沖基金一旦平倉計數,又或好友借歐洲一兩個正面消息反擊,不難殺「空軍」一個片甲不留。從美國商品期貨交易委員會(CFTC)的貨幣投機淨倉統計【圖1】可見,本已高企的歐羅未平倉短盤有增無減,羅傑斯博歐羅在「挾淡倉」下出現較強的反彈,是一個不錯的主意。

然而,在平倉潮退後,歐羅彙價何去何從?這才是值得探討的投資課題。正如羅傑斯自己所言,外界要求歐洲央行把債務「貨幣化」(monetized),是一個可怕的錯誤,希望德國可以「長期抗拒」這種壓力。

然而,不貨幣化財困國債務還不了,歐羅區解體風險與日俱增;貨幣化嗎?德國人對惡性通脹是怎麼回事,比任何人都清楚。Print是死,不print又看不到其他出路,歐羅因此只宜短炒。

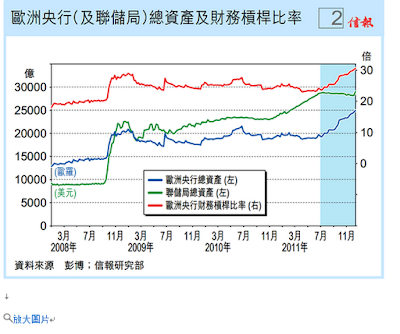

值得注意的是,歐洲央行行長德拉吉雖強調歐盟條約嚴禁進行債務貨幣化,惟透過名目不一著力點不同的救市措施,歐洲央行的資產負債表規模以至財務杠杆比率,自去年中起穩步上揚,跟聯儲局資產負債表規模相比,此長彼消彰彰明甚【圖2】。

歐央行成「垃圾站」

近日有消息說,希臘國民銀行(National Bank ofGreece)發行了一批票息率高達歐洲美元同業拆息加1200點子(12厘)的債券,據知情人士透露,債券並無買家,實際上是發給希臘國民銀行自己的,目的是向雅典政府取得「擔保」,以此作抵押品向歐洲央行換取融資。希臘實際上已跟破產無異,該國政府憑什麼向銀行自發自買的債券提供擔保?傳聞倘若屬實,而歐洲央行對這般垃圾不如的「抵押品」來者不拒,ECB跟廢料收集站何異之有?

從【圖3】可見,聯儲局相對歐洲央行的資產負債表規模,從去夏起此消彼長,以比率計,數字愈低反映歐洲央行從後趕上的勢頭愈淩厲。不難發現,聯儲局QE2於去年6月底結束,而歐洲央行救市措施層出不窮,上述比率下半年持續走低,期間歐羅兌美元彙價雖時有波動,惟一年下來與歐美央行資產負債表消長之勢十分?合。換句話說,歐羅短期表現雖受投機者意向、經濟數據以至政客對歐債危機的取態左右,但中長線而言,歐洲央行相對聯儲局資產負債表規模的此長彼消,指標作用更強。

聯儲局公開市場委員會2012年大換班,去年十位有投票權的決策者,七鴿三鷹,改組後變成九鴿對一鷹之局,聯儲局會否加快推出QE3,足以影響歐美央行資產負債表的規模增減,從而左右歐羅兌美元彙價。

然而,不管是正面量寬還是「後門」放水,歐美救銀行挽經濟皆離不開增加鈔票供應這個獨步單方,歐羅走勢老畢看不通,但說到黃金,我是Long定了!

Jim Rogers

Gold Has Been Up 11 Years In A Row It Deserves A Substantial Correction

It would not surprise me to see gold go to 1200 dollars per ounce – but if it goes that low I’d buy a lot more – gold has been up 11 years in a row it deserves a substantial correction. - in MoneyControl.comhttp://jimrogers-investments.blogspot.com

審計署:地方政府債務超10萬億元

http://economy.caixun.com

[世華財訊]審計署4日發布的“關於2010年度中央預算執行和其他財政收支審計查出問題的整改結果”稱,地方各級政府採取落實償債責任、多渠道籌措償債資金、設立償債準備金等措施,妥善處理存量債務,積極糾正地方政府性債務審計中發現的各類違規問題。

針對違規為464.75億元債務提供擔保問題,有關地方和部門整改到位220.27億元。

針對融資平台公司違規抵押或質押取得債務資金731.53億元問題,有關單位整改到位230.61億元。

針對1319.80億元債務資金未及時安排使用問題,相關地方整改到位1017.47億元。

針對351億元債務資金被投向資本市場、房地產和“兩高一剩”(高能耗、高污染、產能過剩)項目問題,相關單位整改到位140.35億元。

針對融資平台公司虛假出資、註冊資本未到位等2441.5億元問題,相關地方整改到位983.23億元。

按照國務院的部署和要求,審計署對全國所有涉及地方政府性債務的25590個政府部門和機構、6576家融資平台公司、54061個其他單位、373805個項目和1873683筆債務進行了審計。

審計發現,截至2010年底,除54個縣級政府沒有政府性債務外,全國省、市、縣三級地方政府性債務餘額共計107174.91億元。地方政府性債務的舉借和管理等方面還存在一些問題,亟須研究和規範。

政府投資保障性住房審計中發現的違規租售或另作他用以及分給不符合條件家庭的8654套廉租住房,已採取清退收回等方式整改8353套。

此外,審計發現的建設用地供應存在的問題,相關地方通過調整建設用地供應結構和比例等方式,進行了整改。

對長期空置的4428套保障性住房,已有3338套分配入住或列入了分配計劃。

少提取廉租住房保障資金21.49億元問題,相關地方制定了分年度補提計劃,已補提11.19億元;多申報和挪用的0.9億元資金,已全部歸還或調整安排用於廉租房建設。

審計結果公告

10萬億元

截至2010年底全國地方政府性債務107174.91億元。

54個

全國僅54個縣級政府沒有政府性債務。

4.14億元

82個中央部門所屬單位設立4.14億元“小金庫”。目前,73個所屬單位已通過調整賬目和決算報表、收回私存私放資金餘額等方式整改3.75億元。

8654套

審計中發現的違規租售或另作他用以及分給不符合條件家庭的8654套廉租住房,已採取清退收回等方式整改8353套。

699人受處分

截至2011年10月底,相關部門、單位和地區上繳、追回、歸還和補撥資金143.94億元,挽回和避免損失60.66億元,規範賬務處理997.09億元;根據審計意見和建議,制定和完善規章制度1581項;審計發現的139起違法犯罪案件線索及其他違法違規問題移送紀檢監察、司法機關和有關部門查處後,已有699人受到黨紀政紀處分,81人被依法逮捕、起訴或判刑。

14億重建資金被“佔”

關於汶川地震災後恢復重建項目跟踪審計查出問題的整改情況。對21個單位和個人擠占挪用、轉移和套取重建資金14.16億元問題,相關地方和18個單位進行了整改,其餘單位或個人正在籌措資金返還或通過司法途徑催收。

關於玉樹地震災後恢復重建跟踪審計查出問題的整改情況。對24.92億元社會捐贈資金尚未明確到具體項目問題,青海已責成相關單位健全完善了社會捐贈資金撥付機制和管理制度,明確24.92億元捐贈資金的具體項目,並撥付了部分資金。 (廣州日報)

針對違規為464.75億元債務提供擔保問題,有關地方和部門整改到位220.27億元。

針對融資平台公司違規抵押或質押取得債務資金731.53億元問題,有關單位整改到位230.61億元。

針對1319.80億元債務資金未及時安排使用問題,相關地方整改到位1017.47億元。

針對351億元債務資金被投向資本市場、房地產和“兩高一剩”(高能耗、高污染、產能過剩)項目問題,相關單位整改到位140.35億元。

針對融資平台公司虛假出資、註冊資本未到位等2441.5億元問題,相關地方整改到位983.23億元。

按照國務院的部署和要求,審計署對全國所有涉及地方政府性債務的25590個政府部門和機構、6576家融資平台公司、54061個其他單位、373805個項目和1873683筆債務進行了審計。

審計發現,截至2010年底,除54個縣級政府沒有政府性債務外,全國省、市、縣三級地方政府性債務餘額共計107174.91億元。地方政府性債務的舉借和管理等方面還存在一些問題,亟須研究和規範。

政府投資保障性住房審計中發現的違規租售或另作他用以及分給不符合條件家庭的8654套廉租住房,已採取清退收回等方式整改8353套。

此外,審計發現的建設用地供應存在的問題,相關地方通過調整建設用地供應結構和比例等方式,進行了整改。

對長期空置的4428套保障性住房,已有3338套分配入住或列入了分配計劃。

少提取廉租住房保障資金21.49億元問題,相關地方制定了分年度補提計劃,已補提11.19億元;多申報和挪用的0.9億元資金,已全部歸還或調整安排用於廉租房建設。

審計結果公告

10萬億元

截至2010年底全國地方政府性債務107174.91億元。

54個

全國僅54個縣級政府沒有政府性債務。

4.14億元

82個中央部門所屬單位設立4.14億元“小金庫”。目前,73個所屬單位已通過調整賬目和決算報表、收回私存私放資金餘額等方式整改3.75億元。

8654套

審計中發現的違規租售或另作他用以及分給不符合條件家庭的8654套廉租住房,已採取清退收回等方式整改8353套。

699人受處分

截至2011年10月底,相關部門、單位和地區上繳、追回、歸還和補撥資金143.94億元,挽回和避免損失60.66億元,規範賬務處理997.09億元;根據審計意見和建議,制定和完善規章制度1581項;審計發現的139起違法犯罪案件線索及其他違法違規問題移送紀檢監察、司法機關和有關部門查處後,已有699人受到黨紀政紀處分,81人被依法逮捕、起訴或判刑。

14億重建資金被“佔”

關於汶川地震災後恢復重建項目跟踪審計查出問題的整改情況。對21個單位和個人擠占挪用、轉移和套取重建資金14.16億元問題,相關地方和18個單位進行了整改,其餘單位或個人正在籌措資金返還或通過司法途徑催收。

關於玉樹地震災後恢復重建跟踪審計查出問題的整改情況。對24.92億元社會捐贈資金尚未明確到具體項目問題,青海已責成相關單位健全完善了社會捐贈資金撥付機制和管理制度,明確24.92億元捐贈資金的具體項目,並撥付了部分資金。 (廣州日報)

WARNING: Alleged Counterfeit Perth Mint 2012 Silver Dragons

PM龍年大賣....就自不然另到不法份子...有機可乘....各位網友小心

http://forums.silverstackers.com/

Under the Crimes (Currency) Act 1981, it is a federal offence to offer to buy, sell, receive or dispose of "non-excepted counterfeit money". Counterfeits of Perth Mint legal tender bullion coinage falls under this description, as does counterfeits of currency with legal tender status in countries other than Australia. Penalties are up to 12 years imprisonment or $60,000 fines for individuals.

Be very wary of buying either of these coins from sources such as eBay, the likely destination for resale.

An undisclosed member is importing one of these coins for publicising of the issue (the Act permits purchase of counterfeit coins with a "reasonable excuse", which surely the dissemination of a public warning would be acceptable). They will be sharing images of the coin including destructive testing for public education purposes in the next few weeks.

Due to the serious nature of this particular counterfeit (modern premium bullion coins with Australian legal tender status), the owners of Silver Stackers wish to make the following very clear:

If you are suspected or accused of selling these, or any other counterfeit legal tender, via Silver Stackers, the owners of this forum will fully cooperate with the Australian Federal Police in the investigation of the alleged crime.

There will be a ZERO TOLERANCE policy for the trade of these counterfeits on this forum, and confirmed sales of counterfeits via this forum will result in reports being made to the AFP. Silver Stackers will not be party to the trade of counterfeit Australian legal tender.

http://forums.silverstackers.com/

It has come to my attention that a Chinese website is advertising counterfeit Perth Mint 2012 Year of the Dragon 1oz silver coins, and is currently shipping to Australia. It has been disclosed that at least one shipment of 500+ coins is on its way to Australia, presumably intended for resale.

The same seller is also advertising 2011 1oz Gold Kangaroo bullion coins.Under the Crimes (Currency) Act 1981, it is a federal offence to offer to buy, sell, receive or dispose of "non-excepted counterfeit money". Counterfeits of Perth Mint legal tender bullion coinage falls under this description, as does counterfeits of currency with legal tender status in countries other than Australia. Penalties are up to 12 years imprisonment or $60,000 fines for individuals.

Be very wary of buying either of these coins from sources such as eBay, the likely destination for resale.

An undisclosed member is importing one of these coins for publicising of the issue (the Act permits purchase of counterfeit coins with a "reasonable excuse", which surely the dissemination of a public warning would be acceptable). They will be sharing images of the coin including destructive testing for public education purposes in the next few weeks.

Due to the serious nature of this particular counterfeit (modern premium bullion coins with Australian legal tender status), the owners of Silver Stackers wish to make the following very clear:

If you are suspected or accused of selling these, or any other counterfeit legal tender, via Silver Stackers, the owners of this forum will fully cooperate with the Australian Federal Police in the investigation of the alleged crime.

There will be a ZERO TOLERANCE policy for the trade of these counterfeits on this forum, and confirmed sales of counterfeits via this forum will result in reports being made to the AFP. Silver Stackers will not be party to the trade of counterfeit Australian legal tender.

The photos show the obverse and reverse - a Perth Mint replica.

Now the photos could simply be of a real coin, and different products are supplied. Waiting to see what the member receives.

This is the photo though of the 2011 Gold Kangaroo being advertised on the website:

The black rectangle is where I redacted some identifying information (no point advertising where to get them). As can be seen in the photo, the effigy has an obvious gold-plate appearance, instead of the proof-like mirror finish of a genuine coin. Same discrepancy is visible in a few other photos of the coins, including a bulk shot of them in capsules.

How convincing the silver fakes are is yet to be seen, but I would suspect the same issue - no proof-like finishes on the coin. Still, the word needs to get out as a lot of new buyers won't be aware of the difference.

Another view:

Just to be clear, if anyone posts references to the originating site, either names or links, they will be removed.

Now the photos could simply be of a real coin, and different products are supplied. Waiting to see what the member receives.

This is the photo though of the 2011 Gold Kangaroo being advertised on the website:

The black rectangle is where I redacted some identifying information (no point advertising where to get them). As can be seen in the photo, the effigy has an obvious gold-plate appearance, instead of the proof-like mirror finish of a genuine coin. Same discrepancy is visible in a few other photos of the coins, including a bulk shot of them in capsules.

How convincing the silver fakes are is yet to be seen, but I would suspect the same issue - no proof-like finishes on the coin. Still, the word needs to get out as a lot of new buyers won't be aware of the difference.

Another view:

Just to be clear, if anyone posts references to the originating site, either names or links, they will be removed.

訂閱:

文章 (Atom)