While gold demand from the western investors and store of wealth buyers has fallen in recent months, central bank demand continues to be very robust and this is providing strong support to gold above the $1,600/oz level.

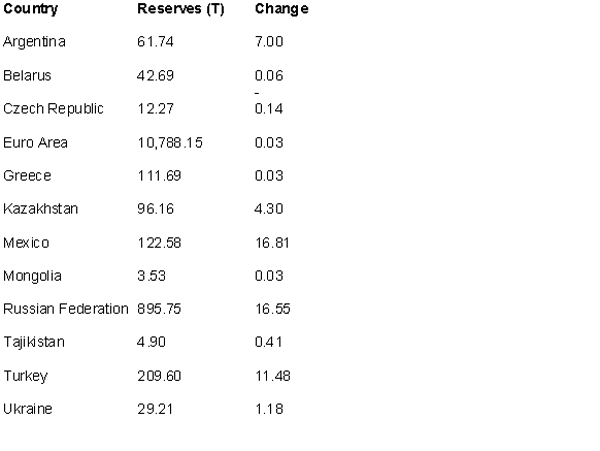

IMF data released overnight shows that Mexico added 16.8 metric tons of gold valued at about $906.4 million to its reserves in March.

Russia continued to diversify its foreign exchange reserves and increased its gold reserves by about 16.5 tons according to a statement by its central bank on April 20.

Changes to Gold Holdings in IMF (March) - Reuters Global Gold Forum

Other creditor nations with large foreign exchange reserves and exposure to the dollar and the euro including Turkey and Kazakhstan also increased their holdings of gold according to the International Monetary Fund data.

Mexico raised its reserves to 122.6 tons last month when gold averaged $1,676.67 an ounce.

Turkey added 11.5 tons, Kazakhstan 4.3 tons, Ukraine 1.2 tons, Tajikistan 0.4 ton, and Belarus 0.1 tonnes, according to the IMF.

Ukraine, Czech Republic and Belarus also had modest increases in their gold reserves.

Central banks are expanding reserves due to concerns about the dollar, euro, sterling and all fiat currencies.

There is an increasing realisation amongst central bankers that gold is a less risky alternative to most paper currencies and a recent survey showed that that majority of central bank reserves managers were favourable towards gold.

Signifying the mood of caution among the world’s central bankers, 71% of those polled said gold was a more attractive investment than it had been at the start of last year.

Central banks added 439.7 tons last year, the most in almost five decades, and may buy a similar amount if not more in 2012, the World Gold Council and many analysts believe.

Turkey’s central bank increased the proportion of required reserves that commercial banks can deposit in gold last year. The changes have increased the amount of bullion the country, which owns 209.6 tons, declares in its official reserves.

President Vladimir Putin

President Vladimir PutinGold accounts for about 3.9 percent of Mexico’s total reserves and 9.7 percent of Russia’s, according to the World Gold Council. That compares with more than 70 percent for the U.S. and Germany, the biggest bullion holders, the data show.

The IMF data records the People’s Bank of China data showing that at the end of March China’s gold reserves remained unchanged at 33.88 million ounces.

This seems hard to believe and it remains likely that China is again quietly accumulating gold reserves and the PBOC will announce a material increase in their reserves when they are ready to do so.