A Sunday Drive In My Tesla.

This story is written in 4 parts:

Part 1. The Car Crash

Part 2. The Economic Crash

Part 3. The Cars

Part 4. Freedom and the Pursuit of Excellence

Part 1. The Car Crash

On Sunday evening, August 26th, I

was in one of the most spectacular car accidents I have ever seen. I was

driving my Tesla Roadster at 25-30 MPH on a tree-lined canyon road in

the Santa Monica Mountains, about to round a slow blind corner. When

suddenly, out from behind the trees came a speeding car skidding out of

control. The corner was posted at 25 MPH…. the oncoming car was

traveling at 50 or 60 MPH. It crossed the centerline of the road fully

into my lane and was heading straight at me.

I veered toward the shoulder of the road and WHAM! The car hit me head

on, pushing my car backwards 20 or 30 feet, and sheering the entire

driver’s side of my car clean off.

The other car, and pieces of my car, continued traveling down the road

behind me another 60-80 feet or so. You can clearly see the other

driver’s skid marks running from my lane to the rear of his car.

The whole accident, from when I first heard and saw the oncoming car to

the moment of impact, took less than a second. The moment of impact

was the most intense, brutal, and violent experience of my life. I

looked at the smoke coming out of the deflating air bag in front of me,

unfastened my seat belt, and stepped out of the car through the area

where my drivers side door used to be.

Later, my passenger said that when he saw the car heading straight for

me, he thought I was a dead man. Luckily, the impact was offset enough

to one side that the oncoming car was deflected by the carbon fiber body

and incredibly strong aluminum frame of my Tesla Roadster.

If I had been driving a different car, or if the oncoming car had hit

me more towards the center of my car, I would not be here typing this

article today… but amazingly, I’m alive. I walked away with just a few

scratches, bruises, and an incredibly sore ribcage and neck.

But the crash that I see coming in the economy will make my little car crash seem insignificant.

Part 2. The Economic Crash

I always say that in every disaster lies an opportunity. What coming

this close to death has done for me is to remind me to enjoy my life.

To always do my best, and enjoy what I’m doing.

Back in 2002, when I began this journey into economics, when gold was

under $400 and silver was under $5, I knew I had an understanding of

what was happening in our society. And I knew I wanted to use that

understanding to help others. Seeing the crazy things governments and

central banks around the world were doing to their economies, I started

sharing what I had learned and encouraging people to do their own

research, decide what they should do, and take action. Now that gold is

over $1,600 and silver is over $30, I can honestly say that I feel both

rewarded and privileged to have played a positive part in helping to

protect many, many people from government stupidity.

But it’s not over yet. I believe the biggest economic crash in history

is still coming at us, and is just around the next bend in the road.

For years I have been getting ready for this economic disaster by

investing every spare dollar into gold and silver. And even though I’m

the guy that sees this economic crash ahead as the greatest opportunity

in history, and even though my gold and silver makes me feel safer and

sleep more soundly, I still worry.

From a monetary historian’s point of view there is no example, in all

of history, of the type of monetary malfeasance currently being

committed by governments and central banks turning out well. In fact,

it always leads to disaster… and this time they are doing it globally!

Historically, when a crisis wipes out a society’s middle class, there

is very often a great political change in that country, and it is always

for the worse. As goes the middle class, so goes the nation. The

middle class is approximately 60%-70% of a nation’s population. They

define a country with their vote and when they are scared, and

threatened with the possibility of a life in poverty, they will vote for

anybody. Usually they will vote for a strong, charismatic leader who

will play on their fears and promise them a way out of their

predicament. In fact, you can trace the rise of Napoleon, Hitler, and

Mao directly to currency crisis and a loss of the middle class.

Today, worldwide, we have the largest middle class in history. In the

U.S., and in many other countries around the world, the generations born

after WWII are spoiled… they have never gone hungry… they have never

known real economic strife. Most of them believe they deserve something

just because they are alive. This creates a dangerous situation. When

you take away a spoiled brat’s toys he throws a tantrum.

For the last 30 years governments and this spoiled middle class have

both been rewarded for taking on ever-increasing mountains of debt.

Like rats learning a maze, debt-dependence is a conditioned response,

brought on by a series of rewards and punishments. Artificially low

interest rates, which have been lower than the real rate of inflation,

have punished savers and rewarded borrowers.

Today’s unsustainable debt and currency crisis is entirely caused by

central banks meddling with the economy. To understand how central

banks artificially goose the economy we need to look at how currency is

created.

Whenever a central bank writes a check it creates a type of currency

they call “base money” (paper currency). The reason currency is created

every time a central bank writes a check is because the check was drawn

on an account that always has a zero balance. Basically they are

committing a fraud and counterfeiting. These brand new units of

currency inflate and dilute the currency supply when they enter

circulation causing the purchasing power of that currency to fall. With

each new unit of currency created, each existing unit of currency has

less purchasing power. The symptom of this inflation and dilution of

the currency supply is rising prices.

Usually, the reason a central bank writes a check is to artificially

stimulate the economy through something called “open market

operations.” The central bank will purchase an asset from the

commercial banks (usually government bonds), which causes the bank’s

balance sheets to be cash-heavy. When the banks have too much cash it

encourages them to promote more loans by lowering interest rates.

But all bank loans are pyramided on top of base money through something

called “fractional reserve lending.” Reserve ratios vary wildly, but

for simplicity I will use a 10% reserve for this example. Let’s say you

are going to buy a house, so you apply for a one million dollar loan.

Under a 10% reserve ratio, the bank is allowed to create $10 of bank

credit for every $1 of base money the bank has on hand. So if the bank

has $100,000 on hand it can legally create $1,000,000 and loan it to

you. The bank then credits your checking account with the newly created

currency. The new units of currency created via your $1 million loan

also inflate and dilute the currency supply and cause prices to rise.

It never ceases to amaze me that nobody goes to jail for all this fraud

and counterfeiting, but that’s how our monetary system works. Crazy…

isn’t it?

Another way that central banks can influence interest rates is by

lowering the interest rate on currency they lend to commercial banks.

In the United States this is called the “Fed funds rate.”

For savers, even though the quantity of currency in their savings

accounts may have increased, they have been punished because the

purchasing power of the currency has fallen faster than the growth of

their accounts. For borrowers, getting as deep into debt as possible

has been rewarded because they can pay off their debts with a cheaper,

lower value currency in the future.

Also, the inflation of the currency supply causes employers to give

employees raises to keep up with the cost of living. So, if your income

doubled in the last decade, the monthly payment on your home loan is

only half the burden. This, coupled with lower interest rates year

after year has rewarded people for refinancing and extracting equity

from their homes.

Now governments around the world and the middle class are deeper in

debt than at any time in history. It’s like they’re standing in water

so deep it’s up to their eyeballs. They can still tilt their heads

back, poke their mouths above the water, and take a breath every once in

a while. But if the water gets any deeper they’ll drown.

Interest rates have been falling since 1980, but that can’t continue

forever. One day soon interest rates, like the water, will rise again.

When they do the spoiled kids are going to be in trouble… it’s all just

part of a cycle.

The global economy has been skidding out of control since the crash of

2008 and the emergency maneuvers are not working. Central banks have

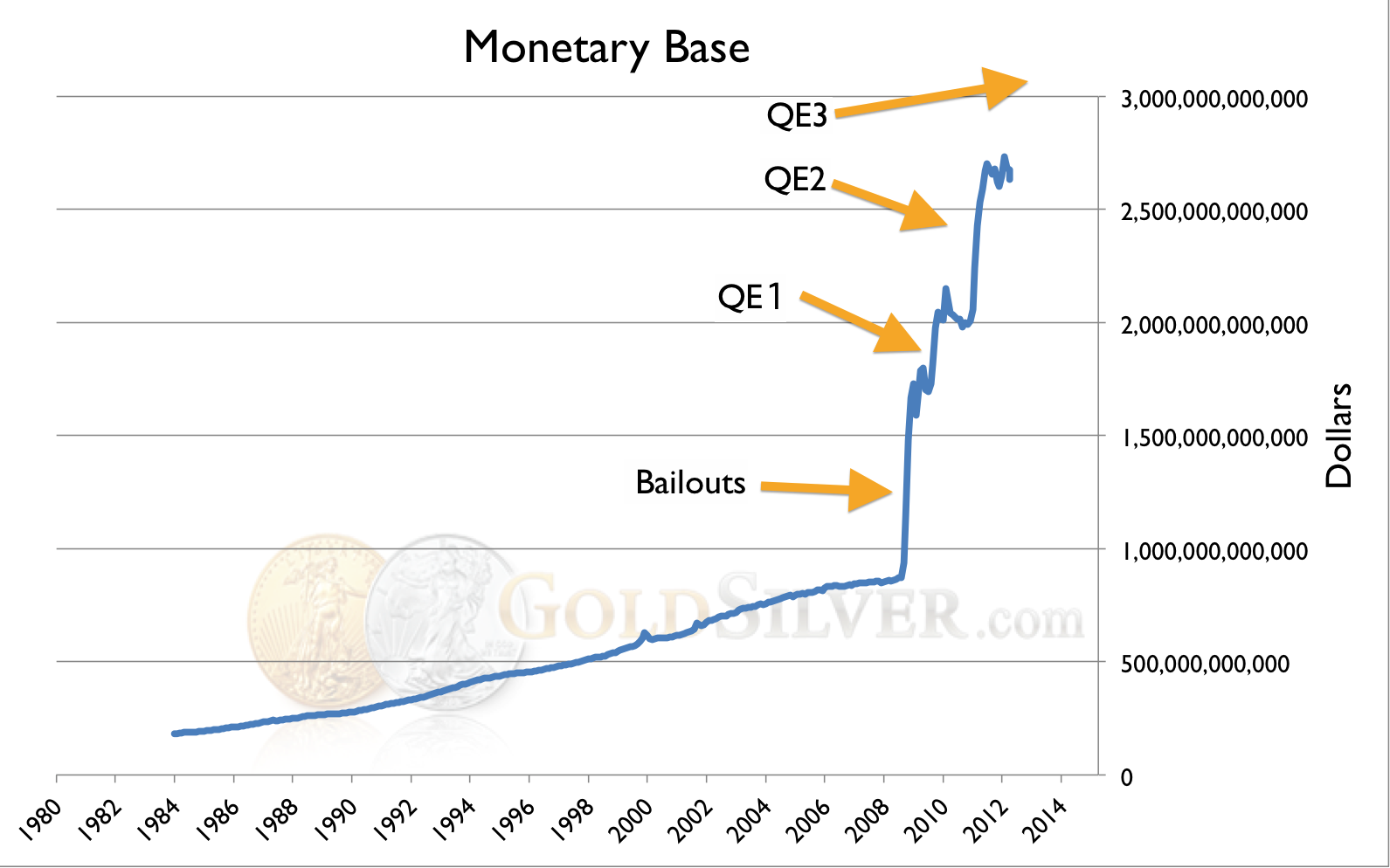

been writing checks like crazy. In the United States the Federal

Reserve has tripled base money (that means that they have created two

times more base money in the past four years than the previous 200

years.) First there were the bailouts. Then there was “QE”

(quantitative easing). Then there was QE2, and now it looks like we’re

about to begin QE3.

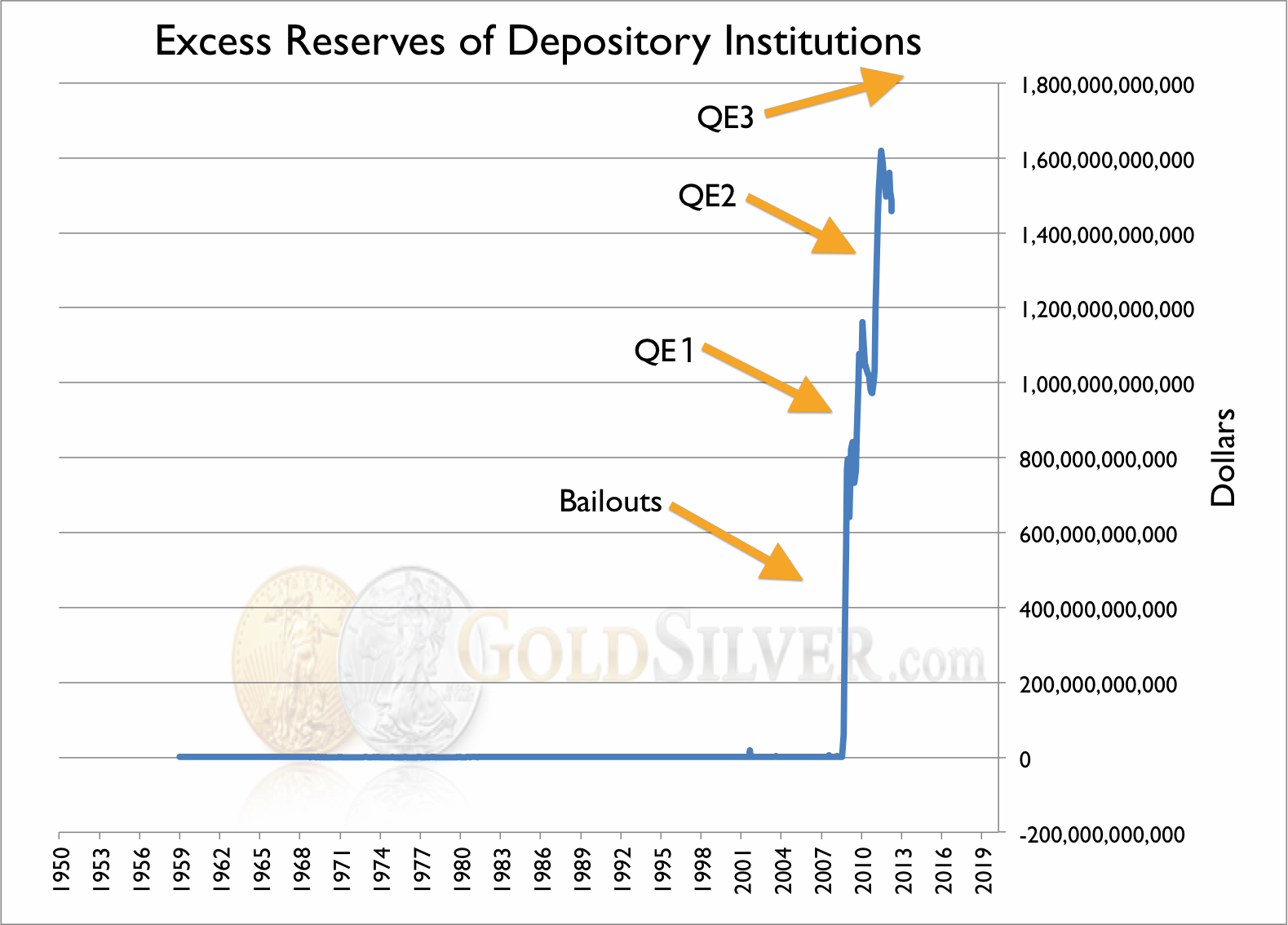

Excess bank reserves (reserves above the minimum that is required for

fractional reserve lending) have gone from about 2 billion to 1.5

trillion (an increase of about 750 times!)

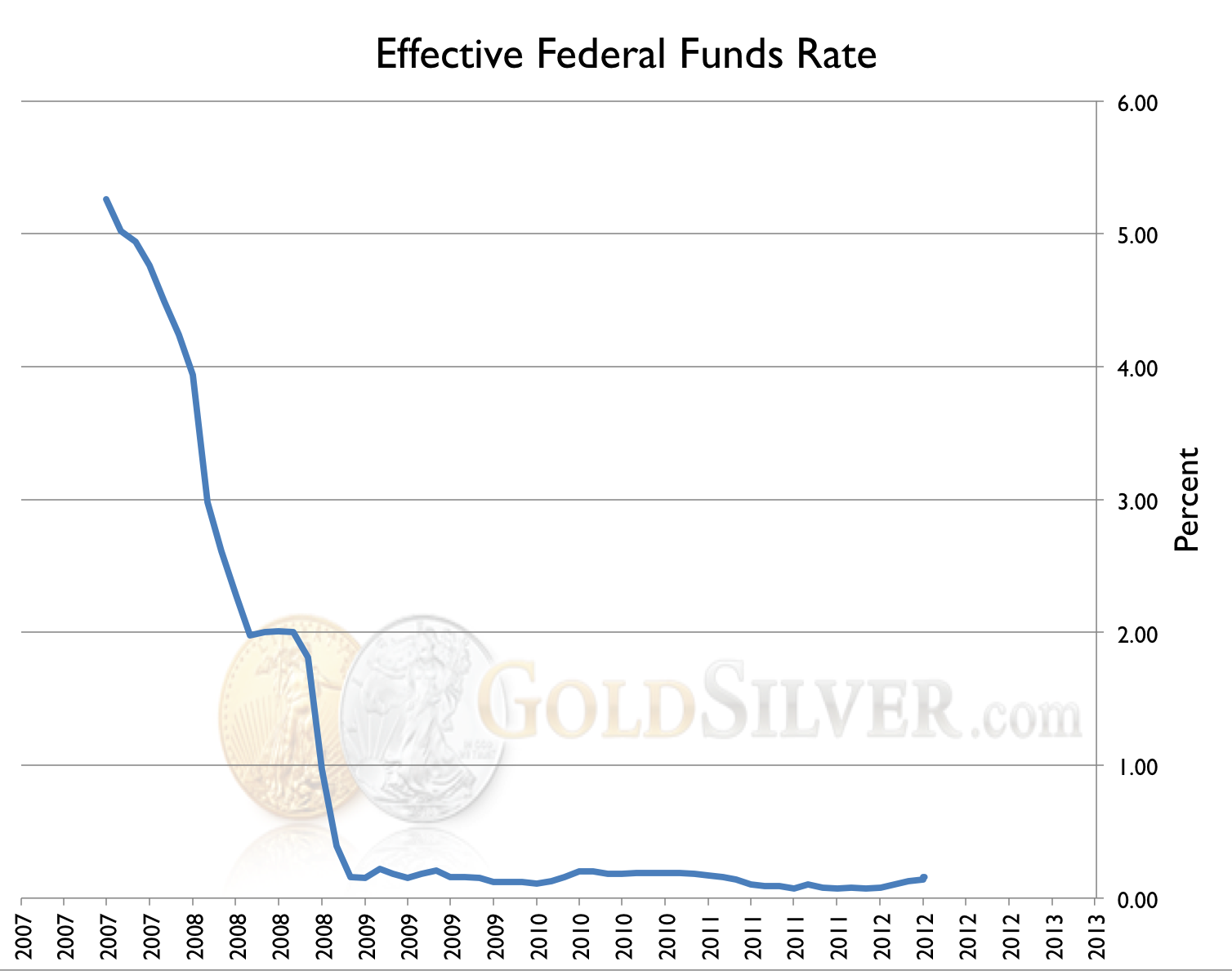

And the Fed funds rate has been held at near zero for almost 4 years now.

So far none of the emergency maneuvers to avoid the crash ahead have

worked. In fact, they’ve pretty much proven it doesn’t work… so now

they’re going to try a whole lot more of it. I believe what they’ve

done is just added to the stored-up economic energy and, just like

stepping on the accelerator to beat a red light, the impending crash is

going to be a whole lot worse.

The recent crash of my Tesla Roadster and the global economic crash

that lies ahead of us have some similarities. Surviving the impact of a

collision is all about the dissipation of energy. By allowing the body

of my Tesla to absorb energy by crumpling and disintegrating it

cushions the impact, while the strong and rigid passenger compartment

maintained its integrity and allowed nothing to intrude, saving my life.

The biggest crash the world has ever seen is happening right now. The

financial vehicle I have chosen to carry me safely through it is gold

and silver.

Part 3. The Cars

Getting back to the Tesla, I wanted to tell you how much I loved that

car. Every time I drove it, I was not only tickled pink, but felt it

was a rare privilege to drive such an extraordinary vehicle. I actually

felt it was the best car ever made. I loved this car so much you could

not give me a Ferrari or Lamborghini over my Tesla. I called it my

little electric land rocket. I used to tell people that when I drove it

“it gave me an electron high,” and that “my right foot would get drunk

on infinite control of immense power.” Actually the term “thrust” might

be more appropriate. It pins you back in the seat as it accelerates

from 0 – 60 MPH in 3.7 seconds.

And it’s sophisticated; it accomplishes this mind-boggling acceleration

silently, without calling attention to itself or imposing itself on

others. I can zip around the mountain roads where I live all night long

without waking anyone up. The juvenile “hey, look at me” drama and

noise required to propel a vehicle using yesterday’s internal combustion

technology is gone, replaced by the faint whirring sound that lets you

know “this is the future.”

It’s a superior technology. For instance, the motor has only one

moving part and requires no oil. It also doesn’t require any

transmission fluid because it doesn’t have a transmission. It doesn’t

need one because it’s electric. The motor has maximum torque from zero

RPM, and will rev all the way up to 15,000 RPM, propelling the car to

125MPH. A transmission is basically a Band-Aid that is required to make

an inferior technology work. And there is no reverse “gear.” When you

want to go backwards you simply press a button that reverses the

polarity of the motor. In fact, if it wasn’t electronically limited to

15 MPH, it could do 125 MPH in reverse!!!

It’s been my daily driver for quite a while now, and because its

battery is full every morning, with its 240-mile range, I never have to

worry about running the batteries down. Since the accident I have had

to drive one of those inferior internal combustion machines again. I

now despise that ancient technology; it has been weighed, it has been

measured, and it has been found wanting. It’s probably been 6-months or

more since I have had to stop for gas… What a pain in the butt. If you

add up all the 5 to 10 minute stops at gas stations you have made over

your lifetime it measures not in hours or days, but, depending on your

age, in weeks or even months!

It’s tiny, tiny, tiny. Did I mention this car was little? In traffic I

had to look up at drivers of Porches, Corvettes, or the door handle of a

mini cooper, or even the lettering of an SUV’s tire. Its diminutive

size and light weight means that it’s agile. With its agility and

acceleration, I feel like everyone else is Wiley Coyote, and I am the

Road Runner.

It’s efficient. In fact, it gets the energy equivalent of 100 miles

per gallon. I drive about 1,000 miles per month, and it uses little

more than $30-$40 worth of electricity.

It’s clean. It has no exhaust pipe. When I’m sitting in stop-and-go

traffic with the window down, looking at and smelling all the exhaust

pipes surrounding me, and realizing my vehicle consumes no energy when

it is standing still, I am literally disgusted by all the other

vehicles. And then a pickup truck will pull alongside me with its

exhaust pipe at my eye level, blowing its noxious burnt dinosaur fumes

directly in my face, and I feel like I’m trapped in an elevator and

everyone else farted.

If you are ever offered a chance to ride in a Tesla Roadster, take it.

Afterwards you will know as fact, not conjecture, that 10 years from

now 80% of the cars being made will be electric. You will also know

that 10-years from now people will point at this little car and say,

“that was the car that changed everything.” It was the moment in

history where electric cars became possible. It was the first time that

the right balance was struck between price, range, and performance. It

was the first electric car the public would buy. It was only because

the Tesla Roadster existed first that Ford, BMW, Honda, Mitsubishi,

Nissan, Smart, Renault, Citroën, and Mercedes-Benz are coming out with

their own electric cars. In 10 years people will look back and say,

“That was the car that changed the world.”

When you drive a Tesla Roadster you know you are driving the future.

But Tesla stopped producing the Roadster last year, so I guess the

future was yesterday.

However, Tesla just started producing the Model S.

It’s an all-aluminum, 4-door, 5-passenger (or 7 if you order the

rear-facing child seats) performance luxury sedan that starts at under

$50,000 (after a $7,500 tax rebate). Depending on the options ordered

it has a range of up to 300 miles and can do 0-60 in less than 4.4

seconds. And to top it off, the EPA says that this big luxury

performance sedan gets the energy equivalent of 89 miles per gallon.

The battery pack is approximately 8 feet long, 5 feet wide, and only 4

or 5 inches tall, so it’s the entire floor of the car. This places

about 1,100 pounds of the car’s weight about 6 inches below axle

height. That means that this car should have the lowest center of

gravity of any production sedan ever made, so its handling is

phenomenal. The motor is underneath the rear seat, which means the

Model S has enormous crumple zones to protect the passenger compartment,

so it is probably one of the safest cars in the world. When you fold

the back seat down, the trunk is large enough to throw a mountain bike

into and you can still fit five or six bags of groceries in the front

trunk (“frunk” in Tesla speak).

I believe the Model S is not only the most well engineered car in the

world, but has redefined what a car can be. If you are thinking about

buying a new car please, please, please go to a Tesla showroom or their

website and take a look. But if you want one you’d better get in line.

Tesla has pre-sold around 13,000 of them, so if you order now, you’ll

probably get yours in about a year. Luckily, I ordered mine around a

year ago and expect to take delivery in a month or two.

Part 4. Freedom and the Pursuit of Excellence

When I would drive my little Tesla Roadster people would stop me and

the conversation would go like this. (I must apologize in advance for

the next paragraph, but I feel so strongly about this that it usually

all comes out in one breath.)

轉載▼

轉載▼

轉載▼

轉載▼