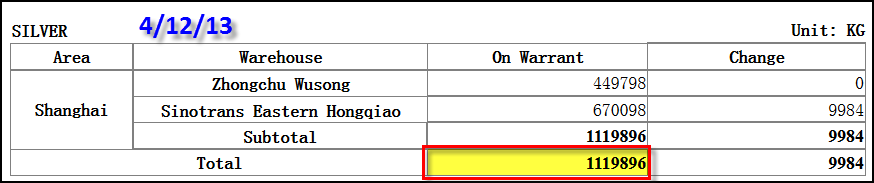

In a little more than half a year, the Shanghai Silver Stocks have declined to new record lows. Before the huge take-down in the price of silver in April, there were 1,120 tonnes of silver at the Shanghai warehouses. By the end of May of this year, the silver stocks fell 32% to only 765 tonnes.

In a little more than half a year, the Shanghai Silver Stocks have declined to new record lows. Before the huge take-down in the price of silver in April, there were 1,120 tonnes of silver at the Shanghai warehouses. By the end of May of this year, the silver stocks fell 32% to only 765 tonnes.

This is a snapshot of the Shanghai silver stocks on April 12th 2013:

From the SRSrocco Report:

and here is the end of May:

By the first week of September, the silver stocks declined another 307 tonnes to hit a new low at 458 tonnes:

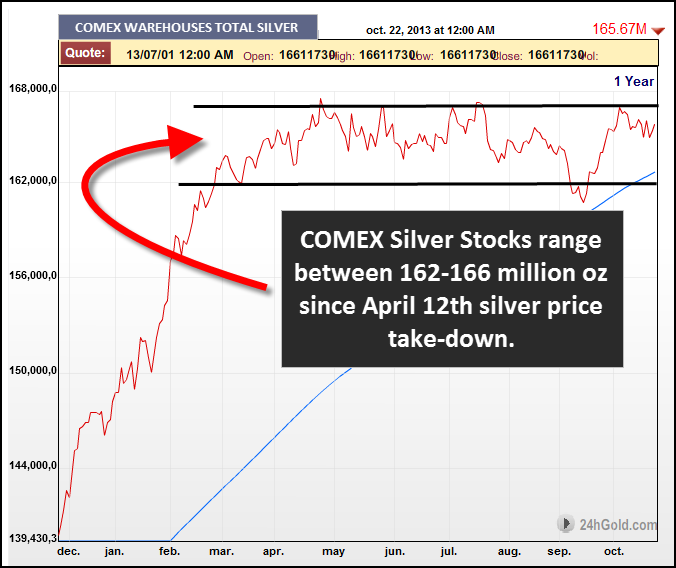

What is surprising here is that as the Shanghai silver warehouse stocks have fallen substantially in less than 5 months (April 12th-September 6th), the Comex silver warehouse stocks basically remained in a tight level of 162-166 million oz shown in the chart below:

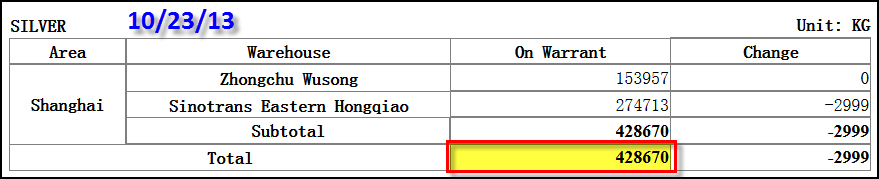

In their most recent update, the Shanghai silver stocks have declined another 30 tonnes since the September 6th update:

In a little more than a half a year, the silver stocks at the Shanghai warehouses have declined 692 tonnes or 62% of their total before the April 12th silver & gold price take-down. It is quite interesting that the silver inventories in Shanghai continue to decline, even though at a slower pace in the past month, while the Comex silver levels remain about the same as they were in April.

Lastly, there are some very interesting trends taking place with U.S. scrap silver exports that I will discuss in a later article. Let’s just say, silver scrap from the United States is showing some significant changes in the amount and type that is being exported.